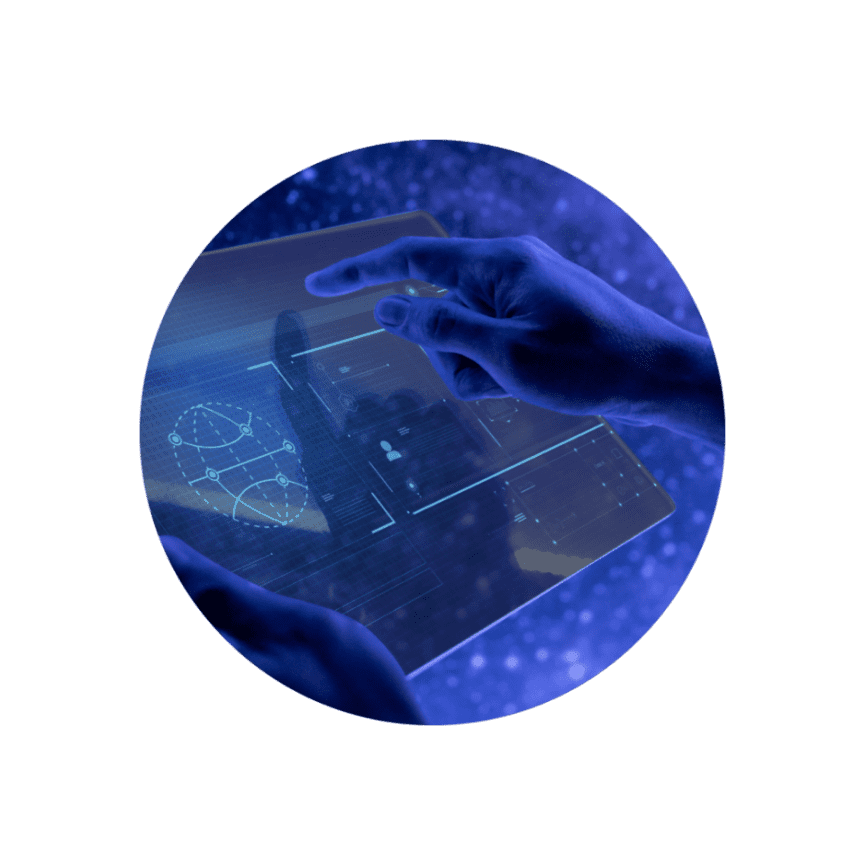

We connect you to the

global financial ecosystem

through a single connection.

We provide mission-critical financial message management over a secure connection

with best-in-class expertise, thus empowering you to achieve complete visibility and control.

We are committed to providing our clients, partners, and global teams

with complete peace of mind.

Why Axletree

We transmit any transaction, from any system, across any network, to anywhere in the world.

Over the past 2 decades, we have designed a solution suite that comprises services across the entire payment lifecycle. And with our origins as a premier Swift Service Bureau, we are still one of the leading players providing Swift connectivity today.

Our clients trust us with their critical financial messaging, amounting to over $100 billion USD processed across the globe every day.

Reach out today to discover how Axletree can help your organization connect to the global financial landscape.

With Axletree, you gain:

A Bespoke

Solution Plan

We work with you to create a unique solution plan that meets your organization's exact needs.

24/7/365

Live Support

Our friendly, expert support team is available to assist you, whenever you need it.

Fast Implementation &

Ongoing Maintenance

Once you're on-board, we complete all mandatory maintenance for you, so you can rest easy.

99.99% Service

Continuity

We provide reliable, consistent service that keeps your transactions moving.

A Proven Track Record

of Expertise

We're confident you won't find our level of service and expertise anywhere else.

A Long-Term

Partnership

Our long-standing clients are proof that once you partner with Axletree, you'll never need to look elsewhere.

Explore our suite of solutions and services designed to streamline

and automate your financial connectivity.

Our Solutions

Bank Connectivity

AXLECONNECT

Connect, transact, and communicate with banks and counterparties quickly, easily, and seamlessly.

Enterprise Integration

SYMMETREE

Process data-rich transactions and communicate with financial ecosystems in any format required.

Business Intelligence

INSIGHTS

Harness the power of data to make informed business decisions and secure your financial future.

Cash and Bank Account Management

CBAM+

Automate your bank account management to unlock greater cash visibility, transactional transparency, and more.

Our Services

Professional Services

Addressing a range of key individual needs, updates, and requirements within the industry.

SWIFT Services

Providing you the support you need to optimize and maintain your in-house SWIFT ecosystem.

SWIFT CSP

Conducting SWIFT CSP independent assessment services for any organization on the network.

ISO 20022

Helping organizations transition to ISO 20022, the enhanced messaging format of the 21st century.

Articles

Resources

-

Our Solutions

-

Our Services

-

Articles

-

Resources

-

AxleConnect Bank Connectivity

Full visibility into all transactions

Swift, APIs, Instant Payments, Host-to-Host, Cross Border Payments

Bank and Non-Bank Connectivity

Connect, transact, and communicate with your banks and counterparties quickly, easily, and seamlessly.

With AxleConnect, transmit any type of financial transaction, to anywhere in the world, across any network.

-

Symmetree Enterprise Integration

Synchronize systems, applications, and file formats for streamlined communication with your counterparties, with our enterprise integration and translation solution.

With Symmetree, communicate seamlessly with all your banking partners, irrespective of the financial languages your organization speaks.

-

Insights Business Intelligence

Descriptive, predictive, & prescriptive forecasting

Performance patterns & trends

AI and machine-learning models

With Insights, identify key patterns & trends using infused analytics to help your business gain the competitive edge.

-

CBAM+ Cash & Bank Account Management

eBAM, Cash Management, FBAR, & more

User-friendly modules, dashboards, & analytics

Minimize risk of human reporting errors

With CBAM+, automate manual cash reporting processes and reduce the risk of human error to enhance your organization’s strategic financial decision-making.

-

Professional Services

Mandatory compliance support

Critical system upgrades & development

Bank onboarding services

Including compliance testing, management of both mandatory and functional upgrades, bank onboarding services, and more, we help your organization stay efficient and operational.

-

SWIFT services

SWIFT Annual Releases

SWIFT Infrastructure Remote Monitoring Services

SWIFT Infrastructure Maintenance

With support for all Swift-related deployments, upgrades, compliance, and maintenance, our Swift experts help your organization connect to the Swift network with the best process and cost efficiency in the market.

-

Swift CSP

Fast implementation

Complete report of findings

Time & cost savings

Complete the annual Swift CSP self-attestation with support from our Swift-certified experts to maintain compliance with Swift and ensure your organization’s secure reputation.

-

Swift GPI

End-to-end payment visibility

gpi integration with your in-house system

Enhanced reporting capabilities

In addition to the enhanced payments transparency of the gpi Tracker itself, Axletree can provide organizations with additional reporting capabilities to provide increased value to their clients and make the most of Swift gpi.

-

Swift g4C

End-to-end payment visibility

g4c integration with your in-house system

Prerequisite analysis and support

Axletree’s Swift experts can help your organization get set up with Swift g4C by providing expert guidance to ensure all prerequisites are met and to streamline the onboarding process.

-

ISO 20022

MX Payment and Statement Adapters

ISO 20022 Format Experts

Comprehensive Format Library

The ISO 20022 messaging standard multiplies the value of financial messages for organizations that choose to transact with it.

With major financial networks making the switch to ISO 20022, Axletree can help your organization deploy a unique solution that meets your level of need while allowing you to stay up to date with the communication trends of the industry.

-

The ISO 20022 Migration is Here

After Swift postponed the ISO 20022 migration from November 2022 to March 2023, many organizations shifted their focus from the migration to other company priorities. Now ...

-

4 ways to improve cross border payments

Do built-in costly time delays, high transfer fees, foreign exchange fluctuations, and high risks of fraud sound familiar? Thankfully, when transacting with global partners and vendors...

-

A Glance at the Swift CSP Changes in 2023

What is Swift CSP 2023? Swift (Society for Worldwide Interbank Financial Telecommunication) is a network that allows financial institutions to communicate and receive information on financial transactions...

-

Product Sheets

Explore our solution offerings in greater detail with our product sheets – including information on uptimes, scope, key benefits, value-adds, and more.

-

Case Studies

Discover how Axletree has helped organizations solve their financial connectivity and integration challenges, resulting in cost reductions and process efficiencies.

-

Newsroom

Check out our newsroom to access all the latest news about Axletree, including partnership announcements, product releases, and our other activities within the industry.

-

FAQ

We’ve answered some of your most common questions. Learn more about Axletree and how we can help you.

- Our Solutions

- Our Services

- Articles

- Resources

-

AxleConnect Bank Connectivity

Full visibility into all transactions

Swift, APIs, Instant Payments, Host-to-Host, Cross Border Payments

Bank and Non-Bank Connectivity

With AxleConnect, transmit any type of financial transaction, to anywhere in the world, across any network.

-

Symmetree Enterprise Integration

With Symmetree, communicate seamlessly with all your banking partners, irrespective of the financial languages your organization speaks.

-

Insights Business Intelligence

Descriptive, predictive, & prescriptive forecasting

Performance patterns & trends

AI and machine-learning models

With Insights, identify key patterns & trends using infused analytics to help your business gain the competitive edge.

-

CBAM+ Cash & Bank Account Management

eBAM, Cash Management, FBAR, & more

User-friendly modules, dashboards, & analytics

Minimize risk of human reporting errors

With CBAM+, automate manual cash reporting processes and reduce the risk of human error to enhance your organization’s strategic financial decision-making.

-

Professional Services

Mandatory compliance support

Critical system upgrades & development

Bank onboarding services

Including compliance testing, management of both mandatory and functional upgrades, bank onboarding services, and more, we help your organization stay efficient and operational.

-

SWIFT services

SWIFT Annual Releases

SWIFT Infrastructure Remote Monitoring Services

SWIFT Infrastructure Maintenance

With support for all Swift-related deployments, upgrades, compliance, and maintenance, our Swift experts help your organization connect to the Swift network with the best process and cost efficiency in the market.

-

Swift CSP

Fast implementation

Complete report of findings

Time & cost savings

Complete the annual Swift CSP self-attestation with support from our Swift-certified experts to maintain compliance with Swift and ensure your organization’s secure reputation.

-

Swift GPI

End-to-end payment visibility

gpi integration with your in-house system

Enhanced reporting capabilities

In addition to the enhanced payments transparency of the gpi Tracker itself, Axletree can provide organizations with additional reporting capabilities to provide increased value to their clients and make the most of Swift gpi.

-

Swift g4C

End-to-end payment visibility

g4c integration with your in-house system

Prerequisite analysis and support

Axletree’s Swift experts can help your organization get set up with Swift g4C by providing expert guidance to ensure all prerequisites are met and to streamline the onboarding process.

-

ISO 20022

MX Payment and Statement Adapters

ISO 20022 Format Experts

Comprehensive Format Library

With major financial networks making the switch to ISO 20022, Axletree can help your organization deploy a unique solution that meets your level of need while allowing you to stay up to date with the communication trends of the industry.

-

The ISO 20022 Migration is Here

After Swift postponed the ISO 20022 migration from November 2022 to March 2023, many organizations shifted their focus from the migration to other company priorities. Now ...

-

4 ways to improve cross border payments

Do built-in costly time delays, high transfer fees, foreign exchange fluctuations, and high risks of fraud sound familiar? Thankfully, when transacting with global partners and vendors...

-

A Glance at the Swift CSP Changes in 2023

What is Swift CSP 2023? Swift (Society for Worldwide Interbank Financial Telecommunication) is a network that allows financial institutions to communicate and receive information on financial transactions...

-

Product Sheets

Explore our solution offerings in greater detail with our product sheets – including information on uptimes, scope, key benefits, value-adds, and more.

-

Case Studies

Discover how Axletree has helped organizations solve their financial connectivity and integration challenges, resulting in cost reductions and process efficiencies.

-

Newsroom

Check out our newsroom to access all the latest news about Axletree, including partnership announcements, product releases, and our other activities within the industry.

-

FAQ

We’ve answered some of your most common questions. Learn more about Axletree and how we can help you.

Our Core Values

We strive to serve our clients every day, guided by our key core values:

BEST CLIENT EXPERIENCE

We ensure each interaction with our clients is relevant, timely, and attentive in order to provide an exceptional client experience.

We differentiate ourselves through our commitment and diligence so that clients not only have their problems resolved. Our clients feel heard because they know they are valued.

BEST CLIENT EXPERIENCE

We ensure each interaction with our clients is relevant, timely, and attentive in order to provide an exceptional client experience.

We differentiate ourselves through our commitment and diligence so that clients not only have their problems resolved. Our clients feel heard because they know they are valued.

Client Testimonials

Our Brand Promise

We Provide Peace of Mind

Managing your financial transactions can be stressful and difficult.

Let us make it easier for you.